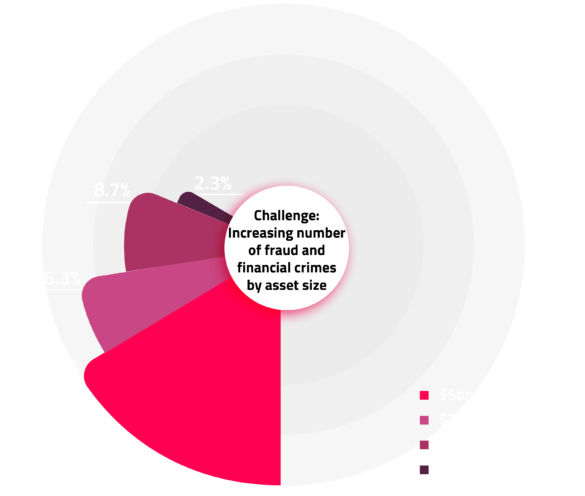

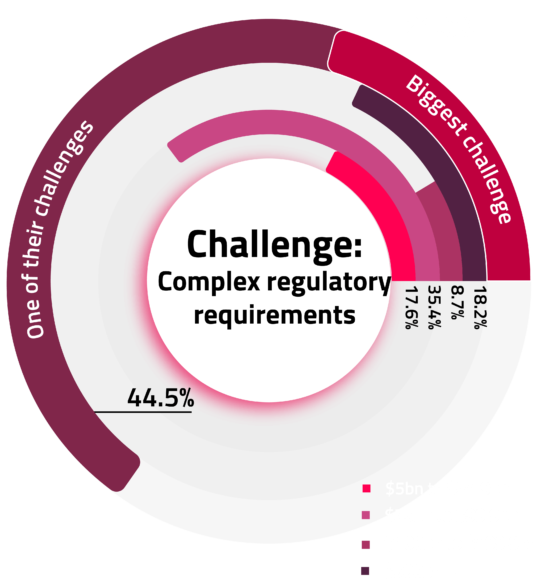

Combatting fraud and financial crime starts with understanding the size and shape of the challenge.

With a lack of standardized reporting to analyze fincrime trends in the market today, financial institutions in the U.S. have struggled to outsmart fraudsters and criminals.

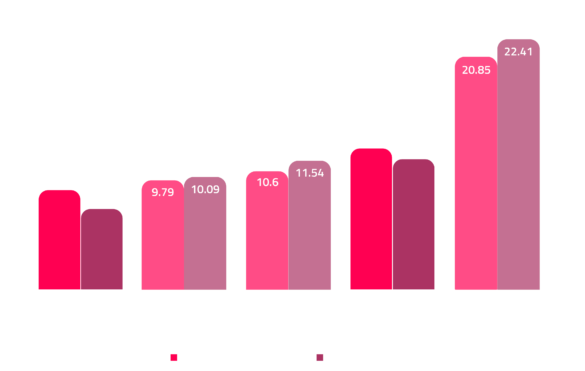

Featurespace partnered with PYMNTS to create the most trusted benchmark of financial crime and fraud challenges, trends and prevention performance, by the industry, for the industry.

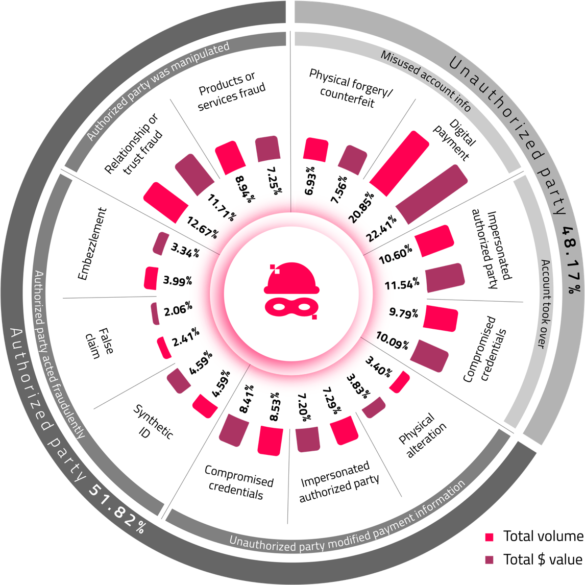

We interviewed executives across 200 U.S. financial institutions to create the first ever benchmark for volume and value of fraud and financial crime, using the FraudClassifier model from the Federeral Reserve to ensure accurate and relevant data.

Now, for the first time, financial institutions have the fraud and financial crime trends data they need to help make the world a safer place to transact.